Meet the team that’s modernizing the RFP process

Join the Plansight team

using technology to improve lives, we’d love to meet you!

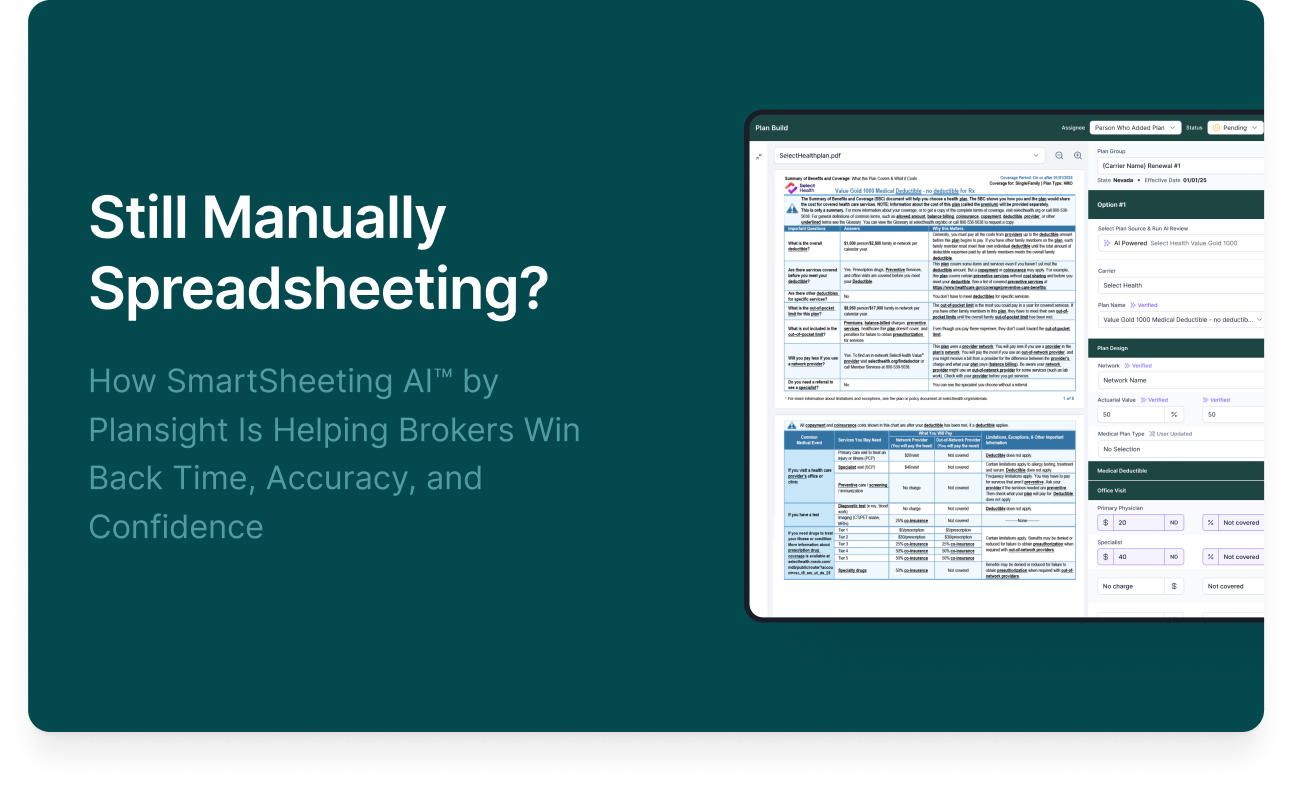

Still Manually Spreadsheeting Carrier Quotes? Your Competitor Isn’t.

How SmartSheeting AI™ by Plansight Is Helping Brokers Win Back Time, Accuracy, and Confidence

Executive Summary

As of 2024, only 6% of insurance agency principals have implemented AI solutions in their workflow. However, that number is quickly rising, with 36% planning to adopt AI tools within the next five years. The pressure is mounting to modernize, yet many brokers are still stuck in one of the most time-consuming and error-prone parts of their process: manual spreadsheeting.

Benefit Teams are expected to deliver fast, accurate plan comparisons. Yet, for many, that still means copying and pasting quote data from PDF proposals into spreadsheets, tweaking formulas, and triple-checking for typos. It’s tedious, risky, inefficient, and it’s holding teams back.

SmartSheeting AI™ by Plansight is a broker-specific automation tool that eliminates the need for manual spreadsheeting. It extracts data from carrier proposals, organizes it into clean, side-by-side comparisons, and empowers brokers to focus on strategy rather than formatting.

At a time when only 17% of agents trust AI and 27% see it as a threat, SmartSheeting AI™ proves that the right technology can support—not replace—broker expertise.

Continue reading to discover how AI is transforming broker workflows, what makes SmartSheeting AI™ uniquely effective, and why now is the time to shift from spreadsheets to intelligent systems.

The Problem with Manual Spreadsheeting

Benefit Teams have long been the unsung heroes of the renewal process, navigating a maze of carrier PDFs, copy-pasting into spreadsheets, checking formulas, and hoping nothing breaks before the presentation. It’s high-stakes work done under tight timelines, and it hasn’t changed much in over a decade.

But the game is changing.

AI-powered tools are eliminating that manual grind, giving brokers a faster, more innovative, and more reliable way to manage proposals and compare quotes. Only 6% of agencies have adopted AI so far, but 36% say they’re planning to in the next five years. The question isn’t if this shift is happening; it’s who will lead it.

Here’s what makes manual spreadsheeting a hidden liability:

Time Drain

Copying and pasting quote data from carrier PDFs into Excel burns hours every week.

Cognitive Load

Constant formula checking, formatting, and version control can create stress and delays.

Error Risk

Manual processes lead to typos, broken formulas, and inconsistent presentation, putting client trust and compliance at risk.

Collaboration Bottlenecks

When spreadsheet logic lives in one person's head, team handoffs become fragile and error-prone.

How SmartSheeting AI™ by Plansight Solves It

SmartSheeting AI™ was built to directly replace the spreadsheeting burden brokers face without changing how carriers deliver data.

Key Capabilities:

AI-Powered Data Extraction

Automatically reads quote data from carrier PDF proposals, mapping it into structured, usable fields.

Instant Comparison View

Generates side-by-side comparisons of plans, organized, interactive, and ready to present (no spreadsheet required).

Human QA, Simplified

Brokers stay in control with lightweight review and edit capabilities before exporting.

Flexible Exports

Need Excel or PDF for clients? SmartSheeting AI™ supports both, providing perfectly formatted results.

Real Impact for Broker Teams

SmartSheeting AI™ helps teams reclaim valuable time, reduce errors, and create more consistent and scalable workflows.

Significant Time Reclaimed Per Renewal

Time previously spent formatting, fixing errors, and troubleshooting spreadsheets is now redirected toward strategic advising and client-facing work.

Fewer Errors, Lower Risk

Automation dramatically reduces copy/paste mistakes and broken logic.

Standardized, Scalable Processes

Client deliverables are consistent across teams, enabling organizations to grow without compromising quality.

Why Now: AI Adoption Is Accelerating

The employee benefits space is evolving. Firms that adapt early will gain a competitive edge.

AI is Here and Growing

The insurance industry is rapidly adopting AI for underwriting, claims, and now broker workflows.

Carrier PDFs Aren’t Going Away

Since carriers won't change how they deliver proposals, brokers need tools that adapt to them.

Top Firms Are Scaling Smarter

Leading brokerages are embracing tools like SmartSheeting AI™ to grow faster without adding headcount.

Addressing the AI Concern: It’s Here to Support, Not Replace

For some, AI can feel like a threat to their role. However, SmartSheeting AI™ is not about replacing brokers; it's about elevating them.

Brokers still own the strategy, plan design, and client experience.

SmartSheeting AI™ takes care of repetitive work, allowing brokers to spend more time advising clients.

Proof and Trust: Is SmartSheeting AI™ Reliable?

Yes, and here’s why:

Proven Results

It’s used by leading firms and brokers across multiple regions and specialties.

Secure by Design

It’s built with data privacy and compliance at its core.

Transparent Workflows

AI doesn't act in a black box; users can see, QA, and edit every field before the final output.

See SmartSheeting AI™ in Action

Ready to see how much time and stress you could save?

Plansight is a modern benefits platform that helps brokers manage RFPs, proposals, and renewals with greater speed, consistency, and insight. With tools like SmartSheeting AI™, we're redefining what efficient, tech-forward brokerage looks like. See why so many others have chosen Plansight as their go-to so you can focus on what matters.